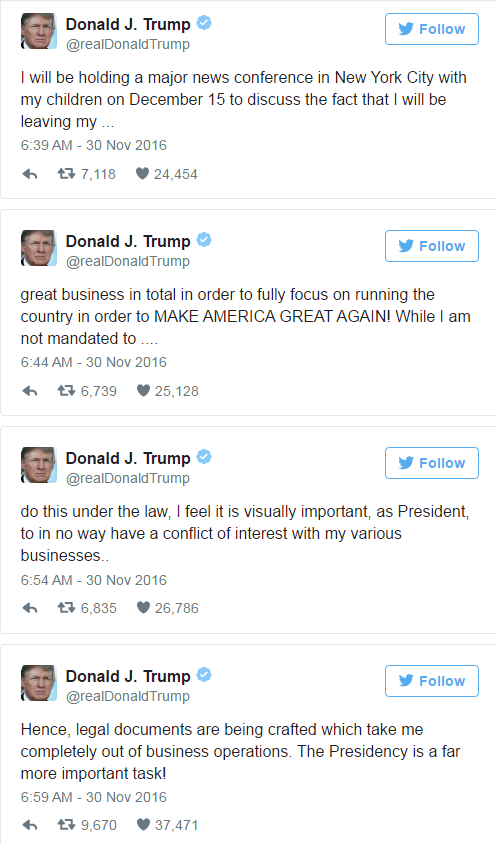

So this morning, we get this set of tweets from the President-Elect:

This is, on its face, the first time, that Trump has acknowledged the appearance of a conflict of interest. And that’s something.

But what is he going to be doing? I wouldn’t get my hopes up.

Leaving his ownership stake to his children will hardly distance the president from his business interests, and would not satisfy the conflict of interest laws that govern the conduct of other elected officials. (Senators, for example, are forbidden from introducing or passing legislation that would further an immediate family member’s financial interest.)

Foreign governments will still take heed of the leverage that surrounds any dealings with Trump-brand properties and their co-investors; lobbyists and business leaders will know what credit accrues to playing on a Trump course or staying at a Trump hotel. This will be especially true if the Trump children continue to play their outsized role in diplomatic meetings.

And, finally, the president himself will never be “blind” to his own interests. After all, they consist mostly of fixed assets stamped with his name.

Meanwhile, we’ve got some more additions to the cabinet:

Yeah. President-elect Donald Trump named Wall Street veteran Steven Mnuchin for Treasury secretary Wednesday, filling key slots on his economic team even as he announced plans to leave his businesses to avoid any conflict of interest. Mnuchin and billionaire Wilbur Ross were asked in a television interview with CNBC if they could confirm reports they had been named to lead the US Treasury and Commerce departments, respectively. Mnuchin, 53, is a former Goldman Sachs partner who was Trump’s campaign chairman and Ross is an investor who has made billions turning around distressed companies.

If you’re concerned even a little about income inequality, this is a gloomy day. Corporate tax breaks, tax breaks for the wealthy, and even trickle down economics.

What’s the first action any new Treasury secretary should take when coming into a situation were cash-rich corporations are raking it in and pocketing the results while automation and wage-stagnation leaves workers behind? You guessed it.

“By cutting corporate taxes, we’re going to create huge economic growth and we’ll have huge personal income,” Mnuchin told “Squawk Box,” confirming he has been tapped for Treasury secretary.

Wilbur Ross is known as “the king of bankruptcy.”

Ross is a businessman in the mold of Trump himself. Known as a sharp negotiator, Ross became wealthy by spotting opportunity in purchasing bankrupt companies in declining industries such as steel, including LTV Corp. in Ohio and Bethlehem Steel in Pennsylvania. He is known for doing the same with failing mining company Horizon Natural Resources, restructuring it and selling it to Arch Coal in 2011 for $3.4 billion. In the aftermath of the 2008 financial crisis, he invested $1.8 billion in faltering banks, from Florida’s BankUnited to several European banks.

And Ricketts? Depuity Commerce Secretary. Cubs Owner.

These are rich guys, but not necessarily guys who understand the economy from a country standpoint.

So much for draining the swamp.

UPDATE: He’s looking at ANOTHER guy from Goldman Sachs:

President-elect Donald Trump is considering Goldman Sachs President Gary Cohn for a senior administration job, possibly as director of the Office of Management and Budget, several sources close to the situation said on Wednesday.

People familiar with the matter say Cohn’s meeting with Trump on Tuesday included talks about a potential job in the new administration, possibly to run OMB, a sprawling office that will handle much of Trump’s budget policy after he takes office in January…

People close to Cohn, an aggressive and imposing trading veteran, note that he has a reputation for attracting and managing top talent, a key attribute for any OMB chief.