Sen. John Cornyn, R-Texas, inserted language into the final tax bill that would enrich three different constituencies: fossil fuel firms, Republicans’ major campaign donors and a handful of Cornyn’s GOP congressional colleagues including Texas Sen. Ted Cruz and two other Texas lawmakers in the House. Cornyn originally added the language in an amendment to the Senate bill at the same time his former chief of staff was lobbying both the House and Senate on the tax treatment for those same oil and gas partnerships.

Cornyn’s amendment ensures Master Limited Partnerships (MLPs), which are publicly traded partnerships that aren’t required to pay corporate income taxes, get the “pass-through” tax break in the final tax bill. Congressional Republicans have settled on a 20 percent deduction for some types of pass-through entities in their final tax bill as a way to give those businesses, which don’t pay corporate taxes, some of the tax relief the bill gives to corporations, which do pay the corporate levy.

MLPs were first created in the 1980s, but by the end of the decade lawmakers, worried about revenue loss, restricted their use to certain industries — primarily natural resource extraction. Today they are mostly used by investors in oil and gas pipelines, who use the vehicles to raise capital and avoid corporate taxes.

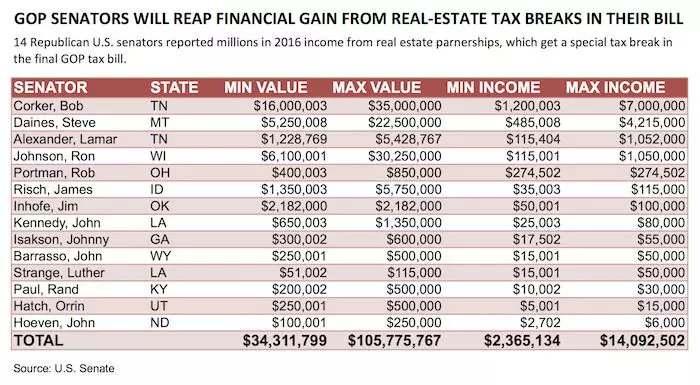

An International Business Times investigation last week revealed that 16 members of Congress — 13 Republicans and three Democrats — are invested in between $4.6 million and $10.6 million worth of MLPs. Those lawmakers stand to benefit from Cornyn’s amendment, which reduces levies on income from MLPs, leaving more money for distributions to investors. Reps. David Trott of Michigan and Thomas MacArthur of New Jersey and Sen. David Perdue of Georgia, all Republicans, are among those who may see the biggest tax reductions.

This may be the only piece of major legislation that Trump will pass, and aside from PERSONALLY benefiting from it, Republicans and Trump are really screwing the lower and middle class. It is a dishonest power and money grab by — and on behalf of — the already powerful. As for “inducements,” well, there are those long-term investments of tens of millions of dollars in campaign contributions (enabled by the collapse of all the guardrails around political money) from wealthy individuals and regiments of interest groups. They will have a merry holiday season if the bill passes as expected.

This legislation proves that Washington is, indeed, the “swamp” President Trump described during the campaign. But instead of draining it, he and his partisan allies have jumped right in. Actually, they have polluted it further.

A prime example of this subtle corruption is how the “compromise” bill deals with the radical scaling back of the deduction for state and local taxes (“SALT”). Gutting the SALT tax break sets back the common good because doing so penalizes states that (a) have progressive income taxes, and (b) have somewhat larger governments and thus tend to invest more in education, infrastructure and programs for the needy. While California, New York and New Jersey are hit hard, many other states are hurt, too.

But instead of restoring all or most of the lost deduction, Republicans offered a fig leaf compromise. Originally, the Senate bill reduced the amount that could be deducted to $10,000 and restricted it to property taxes. The new version keeps the cap while allowing the deduction to be used for sales and income taxes as well.

For most taxpayers who use the existing deduction, this doesn’t solve their problem. One estimate from the Institute on Taxation and Economic Policy found that 1.89 million Californians would still see their taxes rise under the new provision, only a modest drop from the 2.36 million who would have had a tax increase under the version confined to property taxes. Any California representative who votes for this is voting against the interests of the state.

Ah, but the Republicans did want to respond to rich New Yorkers and Californians who were howling to their usual GOP benefactors, including Trump, about their lost SALT deductions.

So rather than offer general relief, the Republicans sliced the top income tax rate — for couples earning $600,000 or more — from the current 39.6 percent to 37 percent. Rep. Kevin Brady, R-Texas, the House Ways and Means Committee chairman, could not really explain why only the best off got real help, arguing lamely that middle-income people got other benefits from the bill.

The shamelessness of Treasury Secretary Steven Mnuchin’s description of the bill on CNN Sunday as “a very large tax cut for working families” is quite staggering. Consider that this confection of loopholes gives lawyers at big firms many paths to lower taxes, but not much to the people who clean their offices. Soon, all Americans will demand the right to transform themselves into “pass-through” legal entities.

The bill’s champions claim that the big corporate tax cut will lead to massive new investment. But, as former New York City Mayor Michael Bloomberg (no enemy of business) pointed out, corporations are already “sitting on a record amount of cash reserves: nearly $2.3 trillion.” Bloomberg added: “It’s pure fantasy to think that the tax bill will lead to significantly higher wages and growth.”

And imagine: The “Make America Great Again” crowd appears to have designed a corporate tax system that creates new incentives to “shift profits and operations overseas,” as former Obama economic adviser Gene Sperling argued in a careful analysis. Trump probably doesn’t even know this.

The key to corruption is operating in the dark. This bill is a mess of opaque provisions that almost no one outside the ranks of tax lobbyists understands — because many of these giveaways were written or inspired by lobbyists themselves.

Needlessly rushing a massive special-interest tax bill through Congress is the antithesis of good government. This doesn’t seem to matter anymore, even to Republicans who built reputations as champions of moderation, openness and rectitude.

To insure that the final bill would have enough votes in both chambers, the conference committee larded the bill with various additional handouts. They reduced the top rate of income tax to thirty-seven per cent, compared to 38.5 per cent in the Senate bill. (Currently, the effective top rate is close to forty-one per cent.) And they did a big favor to large businesses by getting rid of the corporate Alternative Minimum Tax, which many of them could have ended up paying because their tax rates under the new system will be so low.

The principle of simplifying the tax code met the same fate as the principle of fiscal responsibility: it was jettisoned. Originally, the White House proposed reducing the number of tax brackets from seven to three. The final bill contains seven brackets: ten per cent, twelve per cent, twenty-two per cent, twenty-four per cent, thirty-two per cent, thirty-five per cent, and thirty-seven per cent.

According to its authors, the bill will also increase the budget deficit by about $1.5 trillion over ten years (it’s actually closer to $2 trillion), which means that — years from now — Republicans will use that as an excuse to cut social services.

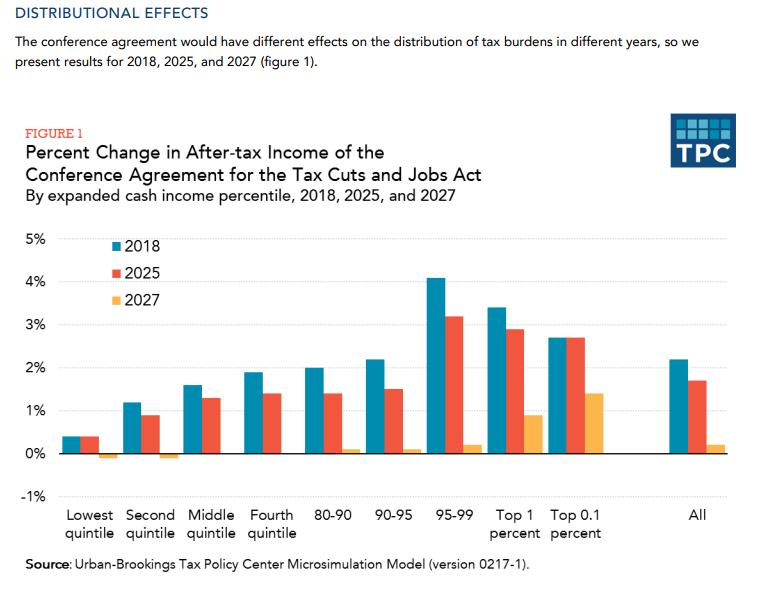

Details aside, here in broad numbers is the bill’s impact 10 years from now, according to the Urban-Brookings Tax Policy Center: Nearly 70 percent of families with incomes of between $54,700 and $93,200 a year would pay more in taxes than they would under current law. By contrast, 92 percent of families whose incomes put them in the top 0.1 percent of the country would get a tax cut averaging $206,280.

As for fairness, that principle was junked a long time ago. The final bill reflects the same principle as the previous two G.O.P. bills: Dom Perignon for the plutocrats, cheap swill for the masses. The bill is also cruel. In abolishing the Affordable Care Act’s mandate to purchase health insurance, it will make individual plans even more costly and more difficult to obtain, especially for sick people. This isn’t just a tax bill. It is a backdoor effort to overturn the principle of universal access to health care.

This truly is the moment that Paul Ryan has been waiting for his whole life, not to mention his political career. The man has no soul:

Today has been a moment decades in the making. Let’s get it done. pic.twitter.com/abuqrCEMPb

— Paul Ryan (@SpeakerRyan) December 19, 2017

Despite protests, it will pass.

MOMENTS AGO: Chants of “kill the bill, don’t kill us!” break out in House of Representatives ahead of vote on major tax bill – ABC News pic.twitter.com/ftoAXyIb60

— Breaking911 (@Breaking911) December 19, 2017

UPDATE: Tax Policy Center Analysis —

Loading...

Loading...

By the way, note that everyone gets a nice tax cut next year (mid-term elections) and the worst effects don’t really come in until later — except for the wealthiest. But by 2027, over half of all Americans — 53% — would pay more in taxes under the tax bill agreed to by House and Senate Republican.

UPDATE: 12 principled Republicans

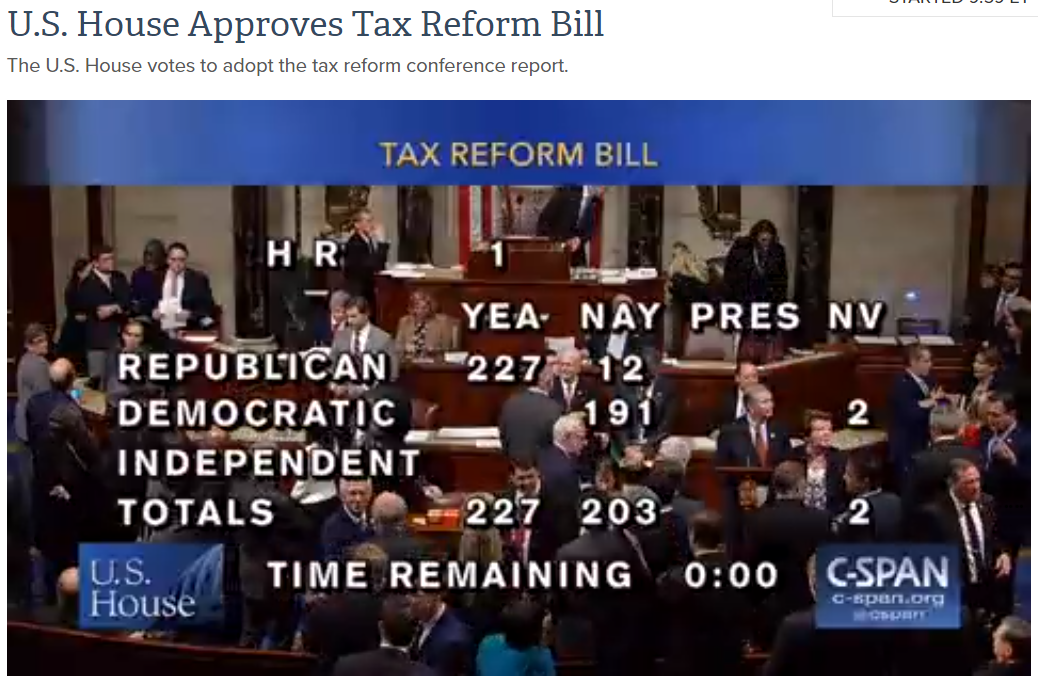

BREAKING: House passes first rewrite of nation’s tax laws in three decades, providing steep tax cuts for businesses, the wealthy.

— The Associated Press (@AP) December 19, 2017

Paul Ryan bangs the gavel like it is Christmas.

12 Republican “no” votes mostly from populous states (because of the SALT issues mentioned above):

UPDATE AGAIN:

Oooops. The House vote was a waste of time, as it turns out. The bill they voted on did not comply with Senate rules (this is what happens when major legislation is passed without proper review and vetting).

But the Senate voted in the wee hours of the morning (December 20) by a 51-48 margin, strictly on party lines (Sen. McCain [R-AZ] is recovering from brain cancer treatment and didn’t vote).

The House is expected to re-vote December 20 with approval, and the the White House will take a victory lap in the afternoon.